Share this Post

Subscribe

Need help with your money or investments? Book a consultation to learn more about working together.

Why Shouldn’t I Just Invest in the S&P 500?

[Prefer to listen? You can find a podcast version of this article here: E241: Why Shouldn’t I Just Invest in the S&P 500?]

When investing, many people turn to the S&P 500 for its historical performance and reputation as a cornerstone of the U.S. stock market.

The S&P 500 tracks the 500 largest publicly traded companies in the U.S.

But is it the best or only option for investors?

It's the most prominent index in U.S. markets and is prominently highlighted in the media, so it's no wonder it lives in the spotlight in most people's minds.

While the S&P 500 can be a great foundation for a portfolio, investing solely in this one segment of the market may not always be the best approach. We'll explore several reasons why relying solely on the S&P 500 might not be the ideal strategy.

Limited Exposure to Global Markets

The S&P 500 only tracks U.S.-based companies. While many of these firms are multinational and derive revenue from global markets, the index still primarily reflects the U.S. economy. Investing solely in the S&P 500 means missing out on opportunities in international markets, where growth prospects might differ.

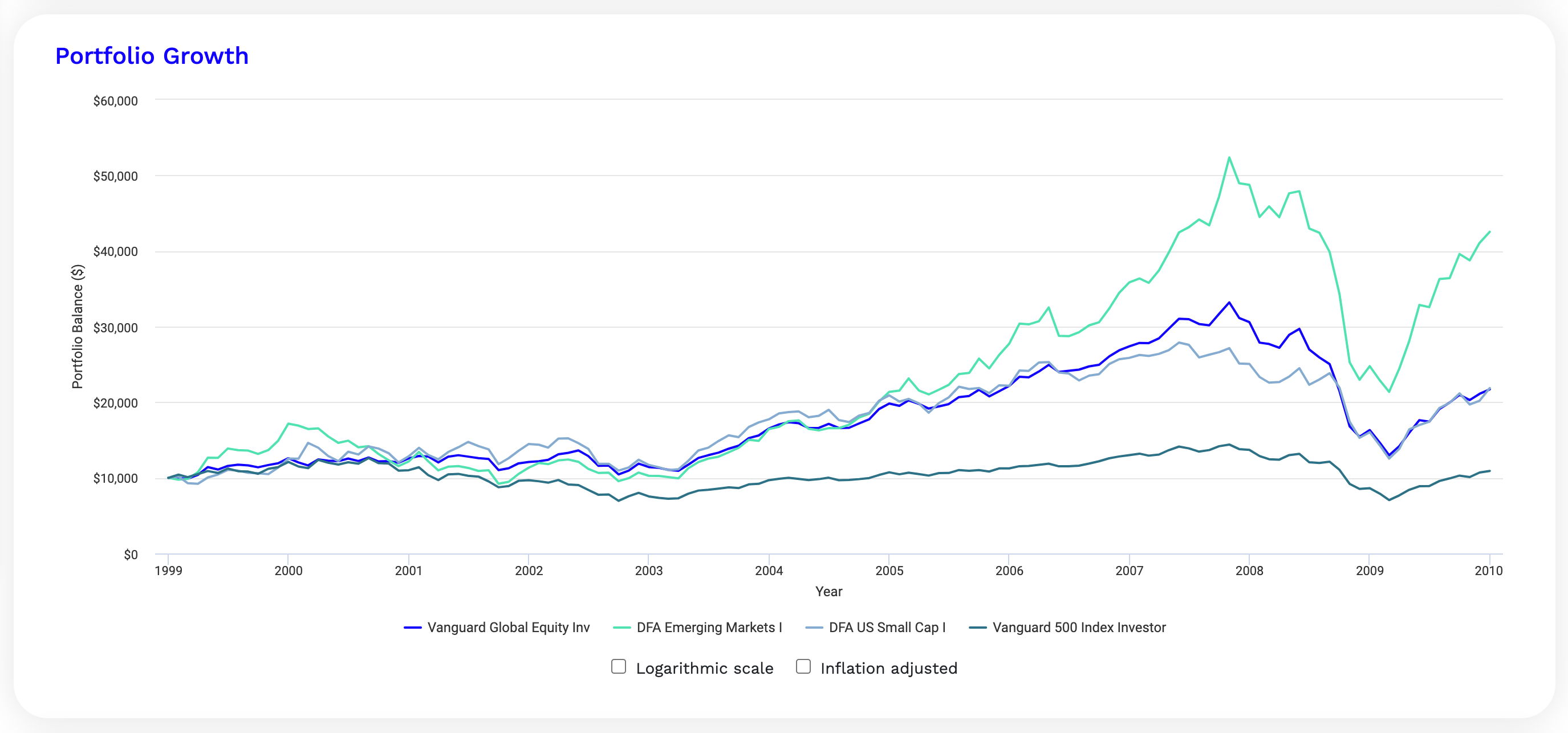

A famous example is the "lost decade"—the period from December 31, 1999, to December 31, 2009, when the S&P 500 had a negative return. While the S&P 500 was negative during this time period, other indexes were positive.

For example, during this same period, global equities, small caps, and emerging markets all outperformed the S&P 500.

This is not the only period to consider, and you can certainly find many periods where the S&P 500 outperformed other indexes. The point is that diversification helps you keep your exposure spread across many different markets, which can reduce your risk.

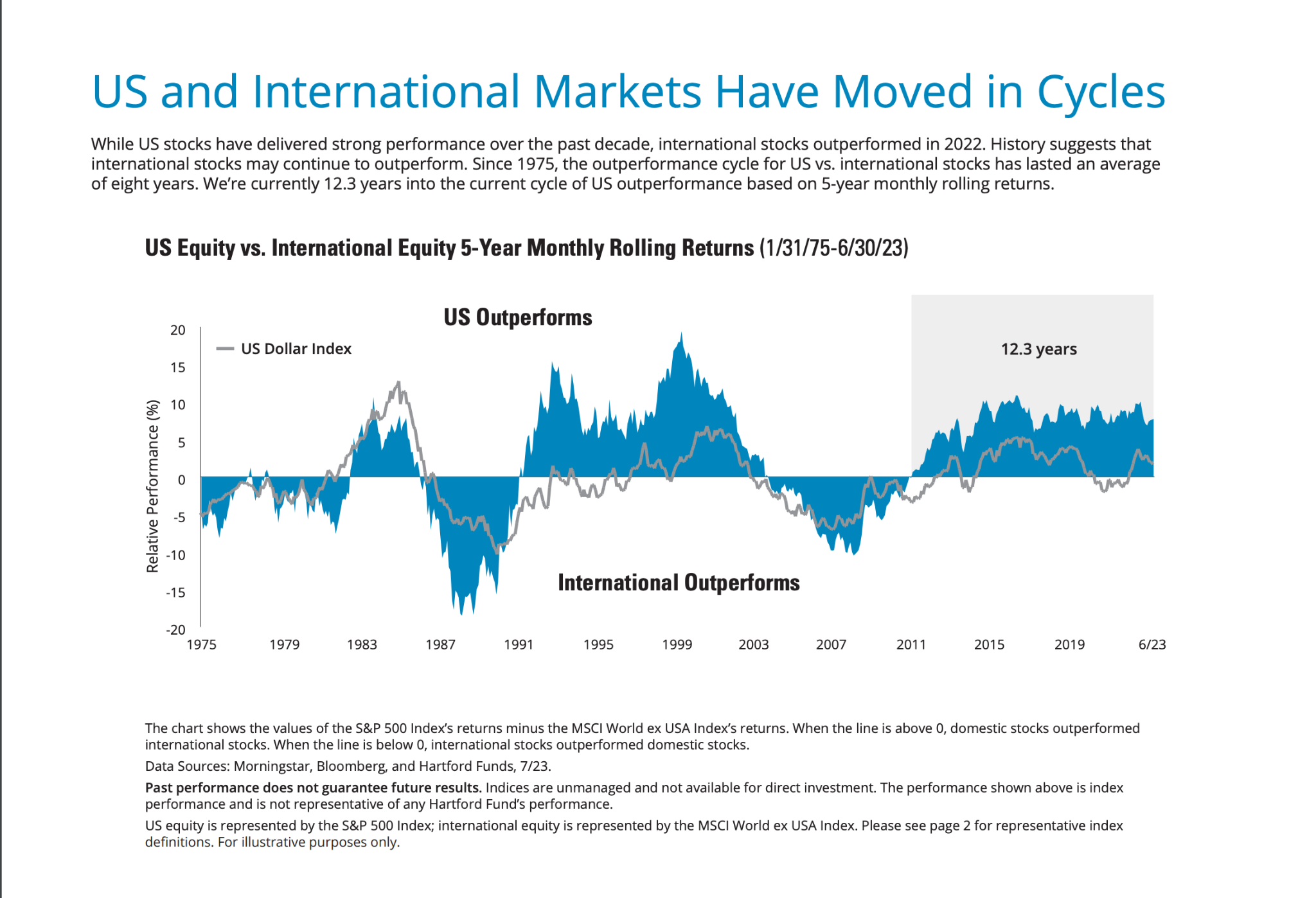

We tend to have home country bias in the U.S. which can lead to thinking that domestic stocks will always outperform. But history shows that there have been plenty of time periods where international markets have outperformed.

Diversifying beyond the S&P 500 can help us take advantage of international markets during periods of outperformance.

Sector Concentration Risk

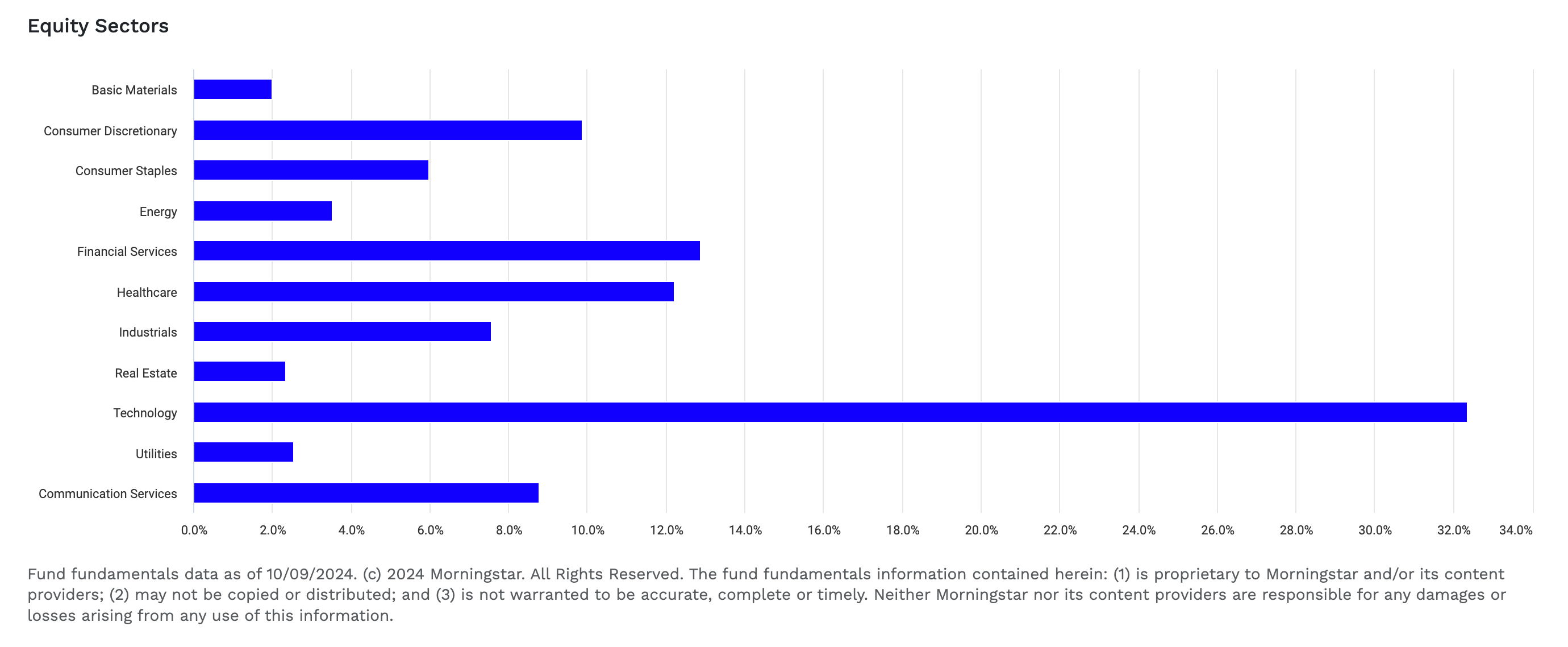

The S&P 500 isn’t as diversified as many think. While it covers 11 sectors of the economy, it is heavily weighted towards certain industries—especially technology. As of recent years, tech giants like Apple, Microsoft, and Google (Alphabet) dominate the index. This can create sector-specific risk.

When tech stocks are soaring, the S&P 500 tends to outperform, but if the tech industry faces challenges, the entire index could suffer. Diversifying into other asset classes or sectors that are underrepresented in the S&P 500—such as small-cap stocks, real estate, or bonds—can help protect your portfolio from these sector-driven downturns.

Below is a breakdown of the current sector allocations in the S&P 500, showcasing the tech-heavy nature of the index.

If you’re over-relying on the S&P 500, you’re also over-relying on just a handful of companies and sectors. A broad diversification into other investments helps mitigate this.

Volatility and Drawdowns

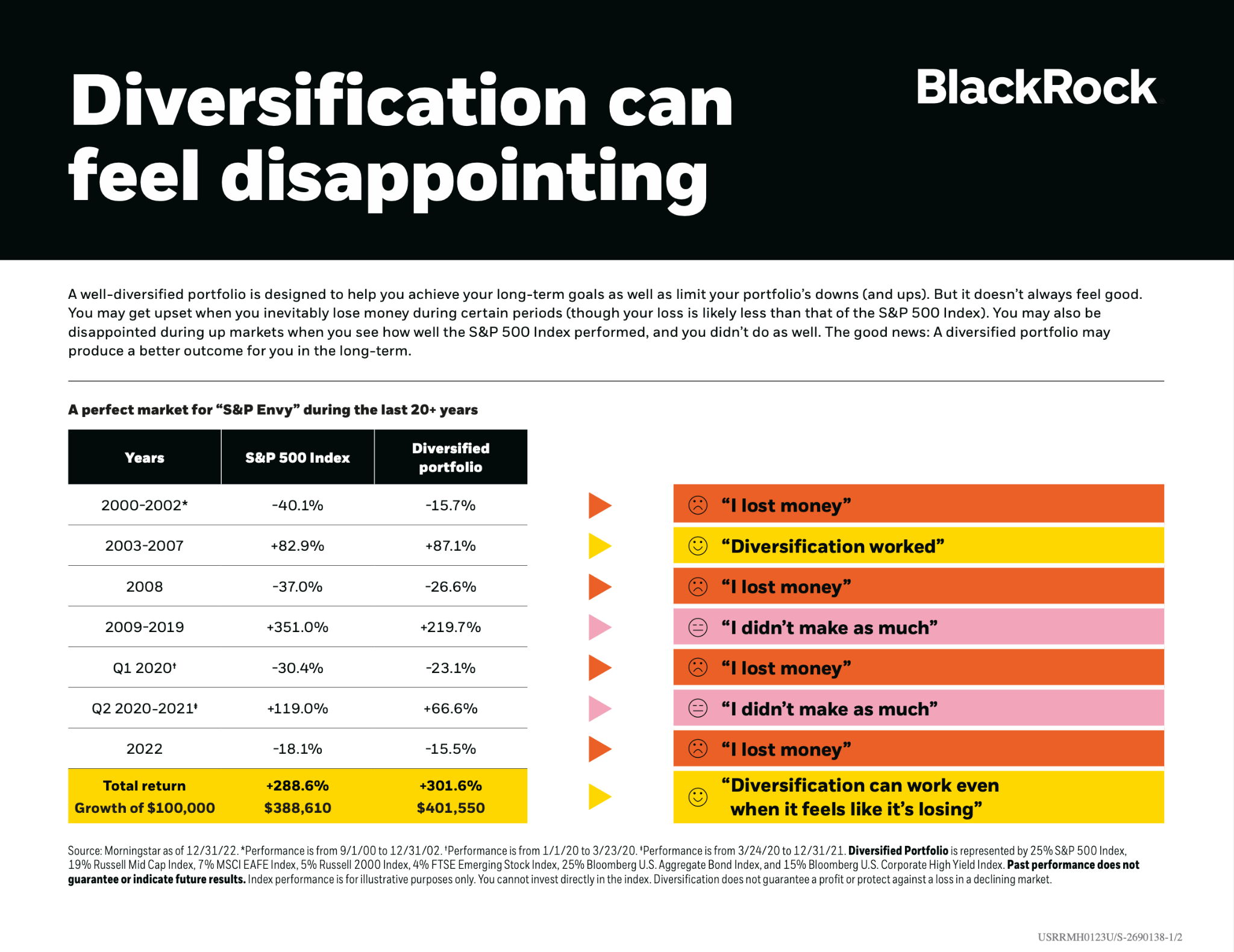

While the S&P 500 has generated solid long-term returns, it’s not without volatility. Over the last 20 years, the index has experienced significant drawdowns during market corrections. The most notable was during the 2008 financial crisis when the S&P 500 lost over 50% of its value from peak to trough.

If you have a lower risk tolerance or are approaching retirement, relying solely on the S&P 500 could lead to uncomfortable swings in your portfolio value.

Over time, this volatility can cause issues both emotionally and mathematically.

It can be stressful to see large swings in your investments. At the same time it can also make it difficult to recover from drawdowns which can affect your total return.

The adage "diversification means always having to say you're sorry" is a common way to describe the reality that a diversified portfolio will inevitably have some underperforming assets. This is because diversification involves owning investments across multiple asset classes, and it's almost impossible to predict which asset class will perform best in a given year.

Tailoring for Your Investment Goals and Risk Tolerance

Perhaps the most important reason to not exclusively rely on the S&P 500 is that it may not align perfectly with your personal financial goals. Every investor has a different risk tolerance, time horizon, and set of financial objectives. While the S&P 500 may be a good fit for a growth-oriented investor with a long-term time horizon, it may not be appropriate for someone who needs more conservative or income-producing investments.

If you're nearing retirement, for example, a mix of income-generating assets like bonds or dividend stocks may be more suitable than a portfolio heavily weighted in growth stocks.

Additionally, if you are interested in ESG / socially responsible investing, you will need to look beyond the S&P 500 to get exposure to these types of investments.

The S&P 500 as Part of a Balanced Portfolio

The S&P 500 is a strong investment choice for many, but it shouldn’t be the only choice. A well-diversified portfolio that includes a mix of domestic and international stocks, real estate, and other asset classes is likely to provide more stability and protection against various risks.

Rather than asking, “Why shouldn’t I just invest in the S&P 500?” consider reframing the question: “How can I build a diversified portfolio that aligns with my goals?”

Incorporating the S&P 500 into a broader strategy allows you to take advantage of its potential for growth while managing the risks associated with market downturns, sector concentration, and other factors.