Share this Post

Subscribe

Need help with your money or investments? Book a consultation to learn more about working together.

The Process and Timeline for Buying Your First Home

[Prefer to listen? You can find a podcast version of this article here: E195: The Process and Timeline for Buying Your First Home]

Owning a home is a dream that many people have. It represents security, independence, and a tangible asset that many see as an important milestone in your financial journey.

But for first-time homebuyers, the path to securing the keys to your own home can come with complexities, countless decisions, and an intimidating timeline.

While it's undoubtedly one of the most significant financial commitments you can undertake, understanding the steps involved can help demystify the process and make it more approachable.

From determining your budget and securing pre-approvals to house hunting and closing the deal, there are a number of steps to consider along the way.

Let’s dig into the process and timeline for buying your first home.

Understanding Your Financial Readiness

Before you begin the home-buying process, it's important to assess your financial readiness. This involves evaluating your current financial situation, including your income, expenses, and credit score.

Understanding your financial standing will help you determine how much you can afford to spend on a home and what type of mortgage you qualify for.

Start by reviewing your monthly income and expenses. Calculate how much you can comfortably allocate towards a mortgage payment without stretching your budget too thin.

There are a few rules of thumb that can help. One set of guidelines includes the ratios used by mortgage lenders.

When lenders evaluate a mortgage application, they typically look at two key ratios to assess the borrower's ability to afford the loan: the housing ratio (or front-end ratio) and the debt-to-income (DTI) ratio (or back-end ratio).

These ratios provide lenders with a snapshot of your financial health and help them determine how much risk they might take on by lending to you. Here's a brief overview:

- Housing Ratio (Front-End Ratio)

- This ratio measures the percentage of your gross monthly income that goes towards housing expenses, which include your potential mortgage payment (principal and interest), property taxes, homeowner's insurance, and possibly homeowner association (HOA) fees.

- Typical Requirement: Many lenders prefer this ratio to be 28% or lower, though this can vary based on the loan type and the lender's specific criteria. Some lenders may accept higher ratios, especially if the borrower has other compensating factors like a high credit score or significant savings.

- Debt-to-Income Ratio (DTI or Back-End Ratio)

- The DTI ratio considers all of your monthly debt payments, not just housing-related ones. This includes credit card payments, car loans, student loans, and other monthly debt payments in addition to your potential mortgage-related expenses.

- Typical Requirement: Most lenders look for a DTI of 36% or lower, but this can also vary. Certain loan programs, like FHA loans, might allow for a higher DTI, sometimes even up to 50% in specific cases.

Remember, while these ratios are guidelines that many lenders use, they're just part of the picture. Lenders will also look at factors like your credit score, employment history, savings, and the type of loan you're applying for.

If one aspect of your financial profile is weak, a strength in another area might help compensate. Always consult with a mortgage professional or financial advisor to understand how lenders will view your specific situation.

It's also important to consider additional costs associated with homeownership, such as property taxes, insurance, and maintenance.

While you may be eligible for a mortgage based on certain ratios, that doesn't mean it's how much house you can truly afford. This is why it's important to evaluate your budget based on your cash flow and other factors in your life.

Next, check your credit score. A good credit score is essential for securing a favorable mortgage rate. If your credit score is less than ideal, take steps to improve it before applying for a mortgage. This may involve paying down debt, making all payments on time, and correcting any errors on your credit report.

Once you have a clear understanding of your financial situation, you'll be better equipped to move forward with the homebuying process. Remember, buying a home is a long-term commitment, so it's crucial to ensure you're financially prepared.

One resource you can use to evaluate your home-buying budget is the Homebuying Budget Calculator from Freddie Mac. It will help you determine how much house you can afford based on your financial information. One useful way to use this tool is to set a budget based on monthly payment, rather than income. Once you've determined how much of a monthly payment you can afford based on your specific cash flow situation, it will help you set a realistic home budget.

Saving for a Down Payment

Now that you know your financial readiness, it's time to start saving for a down payment. A budget will help you prioritize your expenses and allocate funds towards your homeownership goals.

First, track your monthly expenses and identify areas where you can cut back. This could mean reducing discretionary spending, renegotiating bills, or finding ways to save on everyday expenses. By making small adjustments, you can free up more money to put toward your down payment.

Next, set a savings goal for your down payment. Most lenders require a minimum down payment of 5-20% of the home's purchase price. Aim to save at least 20% if possible, as this will allow you to avoid private mortgage insurance (PMI) and potentially secure a lower interest rate.

In addition to a conventional mortgage, many first-time homebuyers may want to consider an FHA mortgage.

An FHA mortgage is a type of government-backed home loan provided by lenders but insured by the Federal Housing Administration (FHA). This insurance makes FHA loans less risky for lenders, allowing them to offer more favorable terms. Here are some key features and details about FHA mortgages:

- Lower Down Payments: One of the biggest draws of FHA loans is the ability to make a down payment as low as 3.5% of the purchase price, depending on your credit score.

- Credit Flexibility: FHA loans tend to be more lenient with credit score requirements. Borrowers with lower credit scores might still qualify, although they might be asked to make a larger down payment.

- Mortgage Insurance: Because of the lower down payment and increased risk to the lender, FHA loans require two types of mortgage insurance premiums:

- Upfront Mortgage Insurance Premium (UFMIP): This is a one-time premium paid at closing, which can be financed into the loan amount.

- Annual Mortgage Insurance Premium (MIP): This is a recurring yearly premium split into monthly payments and added to your regular mortgage payment. The exact cost varies based on the loan's term and loan-to-value ratio.

- Loan Limits: FHA loans have limits on how much you can borrow, which vary by region and are adjusted annually. These limits are based on the local housing market and are meant to ensure the program serves low- to moderate-income borrowers. See what the FHA loan limits are for your area using the FHA Mortgage Limits tool from The U.S. Department of Housing and Urban Development.

- Owner-Occupied Requirement: FHA loans are typically for owner-occupied properties. This means you're expected to live in the property as your primary residence.

- Property Standards: Homes purchased with an FHA loan must meet specific safety, efficiency, and habitability standards. If a home doesn't meet these standards, any issues must be addressed before the purchase.

- Refinancing Options: The FHA also offers streamlined refinancing options for existing FHA loan borrowers, often with reduced paperwork and underwriting requirements.

- Variety of Loan Types: While most associate the FHA with traditional fixed-rate mortgages, they also back adjustable-rate mortgages and other types of housing loans.

FHA loans are particularly popular among first-time homebuyers because of their lenient requirements. However, it's essential to weigh the pros and cons, especially concerning the costs associated with mortgage insurance, when considering this type of loan. Always consult with a mortgage professional to determine which loan product is best for your situation.

Consider opening a separate savings account dedicated to your down payment. This will help you keep your savings organized and prevent you from dipping into the funds for other purposes. Automate regular contributions to this account to ensure consistent progress toward your savings goal.

Remember, saving for a down payment may take time and discipline. Be patient and stay focused on your goal. With a solid budget and a clear savings plan, you'll be one step closer to achieving homeownership.

Getting Pre-Approved for a Mortgage

Once you have saved for a down payment, it's time to get pre-approved for a mortgage. Pre-approval is an important step in the home buying process as it demonstrates to sellers that you are a serious buyer and have the financial means to purchase their property.

To get pre-approved, you'll need to gather your financial documents, such as pay stubs, bank statements, and tax returns. These documents will provide the lender with a comprehensive view of your financial situation and help them assess your borrowing capacity.

Next, reach out to multiple lenders to compare mortgage rates and terms. This will ensure you get the best deal possible. Provide each lender with the necessary documents and complete their pre-approval application. The lender will then evaluate your financial information and provide you with a pre-approval letter stating the amount you are qualified to borrow.

Having a pre-approval letter in hand will give you a competitive edge when making an offer on a home. It shows sellers that you are ready and able to move forward with the purchase. Keep in mind that pre-approval is not a guarantee of a mortgage loan. You will still need to go through the formal application process once you find a home and have an accepted offer.

One question that many couples have at this stage is to ask if both people should be on the mortgage. If you're an individual buying a home, the question of "who is on the mortgage" is pretty simple. However, as a couple, you have the option to have both of you on the mortgage or just one of you.

If both partners have a good credit score and strong income, then it can be advantageous to apply as a couple since this can help you qualify for a higher amount (assuming it fits within your budget). However, if one partner has bad credit, it may make sense for the partner with a good credit score to be the only person on the mortgage in order to qualify for the best rate.

Note that even if only one person is on the mortgage, both partners can be listed on the title if that's what you desire.

Finding a Real Estate Agent

Now that you're pre-approved for a mortgage, it's time to find a real estate agent who will guide you through the home search and negotiation process. A good real estate agent will have a deep understanding of the local market, access to a wide range of properties, and strong negotiation skills.

Start by asking friends and family for recommendations. Personal referrals are often the best way to find a reliable and trustworthy agent. You can also search online for real estate agents in your area and read reviews from past clients.

Once you have a list of potential agents, schedule interviews to get a sense of their experience and approach. Ask about their knowledge of the local market, their availability, and their track record of successful transactions. It's important to find an agent who understands your needs and is committed to helping you find the perfect home.

Remember, you'll be working closely with your real estate agent throughout the homebuying process, so it's crucial to find someone you feel comfortable with and trust. Take your time and choose an agent who aligns with your goals and priorities.

Searching for Your Dream Home

With a real estate agent by your side, it's time to start searching for your dream home. Begin by identifying your must-haves and deal-breakers. Consider factors such as location, size, number of bedrooms, and amenities that are important to you.

Your real estate agent will set up automated property alerts based on your criteria and schedule viewings for the homes that interest you. Take the time to visit each property and assess its suitability to your needs. Don't be afraid to ask questions and voice any concerns you may have.

As you visit different properties, keep an open mind. Sometimes, a home may not check all the boxes on your list but has the potential to become your dream home with a few modifications or updates. Trust your real estate agent's expertise and consider their suggestions.

Once you find a home that meets your criteria and feels right, it's time to make an offer.

Making an Offer and Negotiating the Purchase Price

When making an offer on a home, it's important to strike a balance between getting a good deal and not alienating the seller. Your real estate agent will help you determine the appropriate offer price based on market conditions, comparable sales, and the condition of the property.

In addition to the purchase price, your offer may include contingencies such as a satisfactory home inspection, appraisal, and financing. These contingencies protect you as the buyer and give you an opportunity to renegotiate or walk away if significant issues are discovered.

Your real estate agent will present your offer to the seller's agent, who will communicate it to the seller. The seller can accept, reject, or counter your offer. Negotiations may go back and forth until both parties reach a mutually acceptable agreement.

Remember, negotiation is a delicate process. It's important to remain respectful and open to compromise. Trust your real estate agent's guidance and expertise throughout the negotiation process.

Completing the Home Inspection and Appraisal

Once your offer is accepted, it's time to complete the home inspection and appraisal. The home inspection is an opportunity to assess the condition of the property and identify any potential issues or repairs that may be needed.

Hire a licensed home inspector to conduct a thorough examination of the property. The inspector will check the major systems of the home, such as the plumbing, electrical, and HVAC, as well as the overall structure and safety features. They will provide you with a detailed report highlighting any issues or concerns.

Simultaneously, the lender will order an appraisal to determine the fair market value of the home. The appraiser will visit the property and evaluate its condition, location, and comparable sales in the area. The appraisal is crucial for the lender to ensure they are not lending more than the property is worth.

If the home inspection or appraisal reveals significant issues, you may have the opportunity to negotiate repairs or a lower purchase price. Your real estate agent will guide you through this process and help you make informed decisions.

Finalizing the Financing and Closing the Deal

With the home inspection and appraisal complete, it's time to finalize the financing and close the deal. This involves working closely with your lender to provide the necessary documentation and complete the mortgage application process.

Your lender will review your financial information, order a title search, and prepare the necessary loan documents. You may need to provide additional documents or explanations if requested by the lender. It's important to be responsive and proactive during this stage to ensure a smooth closing process.

Once all the paperwork is in order, you'll schedule a closing date with the seller. At the closing, you'll review and sign the final documents, including the mortgage loan agreement, title deed, and any other relevant paperwork. You'll also pay closing costs, which typically include lender fees, attorney fees, and prepaid expenses such as property taxes and insurance.

After the closing, the property will be officially transferred into your name, and you'll receive the keys to your new home. Congratulations, you're now a homeowner!

Typical Timeline

The timeline for buying a home can vary significantly based on several factors, including market conditions, the buyer's preparedness, and unforeseen challenges. However, for a general idea, here's a typical timeline for the home-buying process:

- Pre-Approval and Financial Preparedness (1-4 weeks):

- Research lenders and gather necessary documents.

- Obtain mortgage pre-approval, which can give you a competitive edge in a hot market.

- Find a Real Estate Agent (1-2 weeks):

- Interview and select a realtor to help you navigate the home-buying process.

- House Hunting (4 weeks - several months):

- Determine your must-haves and deal-breakers.

- Visit open houses and schedule showings.

- The duration of this stage can vary widely based on your requirements and local market conditions.

- Make an Offer and Negotiate (1 week):

- Once you find a home you love, submit an offer.

- The seller might accept, reject, or counter your offer, leading to negotiations.

- Under Contract and Due Diligence (30-45 days, typically):

- Once both parties agree on terms, the house goes "under contract."

- Schedule a home inspection to identify any potential issues.

- Depending on inspection results, you might renegotiate or even back out if major issues are found and not resolved.

- Secure Financing (Concurrent with the above step, roughly 30-45 days):

- Finalize your mortgage application.

- The lender will order an appraisal to ensure the home's value matches the selling price.

- The underwriter will review all documents and might ask for additional information before approving the loan.

- Closing (1 day):

- Final walk-through to ensure the property's condition hasn't changed.

- Sign all necessary paperwork to transfer ownership.

- Obtain keys to your new home!

- Move In! (Variable):

- Depending on your situation, you might move in immediately or have some gap between closing and move-in day.

The entire process, from pre-approval to moving in, generally takes 2-3 months on average. However, this timeline can be shorter or longer based on the factors mentioned earlier. Always work closely with your real estate agent and lender, as they can provide guidance tailored to your situation and keep things moving efficiently.

Moving into Your New Home and Post-Purchase Considerations

Moving into your new home is an exciting milestone, but there are a few additional considerations to keep in mind. Take the time to update your address with relevant parties, such as your employer, banks, and utility companies. Set up utilities and services at your new address, such as electricity, water, internet, and cable.

Consider hiring professional movers or enlisting the help of friends and family to make the move as smooth as possible. Take the opportunity to declutter and organize your belongings as you pack and unpack.

Once you're settled in your new home, it's important to prioritize ongoing maintenance and regular inspections. Create a schedule for tasks such as changing air filters, cleaning gutters, and servicing HVAC systems. Regular maintenance will help you protect your investment and ensure the longevity of your home.

Also, don't forget to update your estate documents to include your new home. If your state allows it, you may even want to consider establishing a transfer on death deed for your home so that it passes to the proper beneficiaries in the event of your passing. We don't like to think about possible tragedies (especially during such a happy occasion) but planning ahead for unexpected events is always important.

Lastly, take the time to enjoy your new home and make it your own. Personalize your space with decor and furniture that reflects your style and personality. Invite friends and family over to celebrate your homeownership milestone.

Remember, buying your first home is a significant accomplishment. Take pride in your achievement and enjoy the benefits of having a place to call your own.

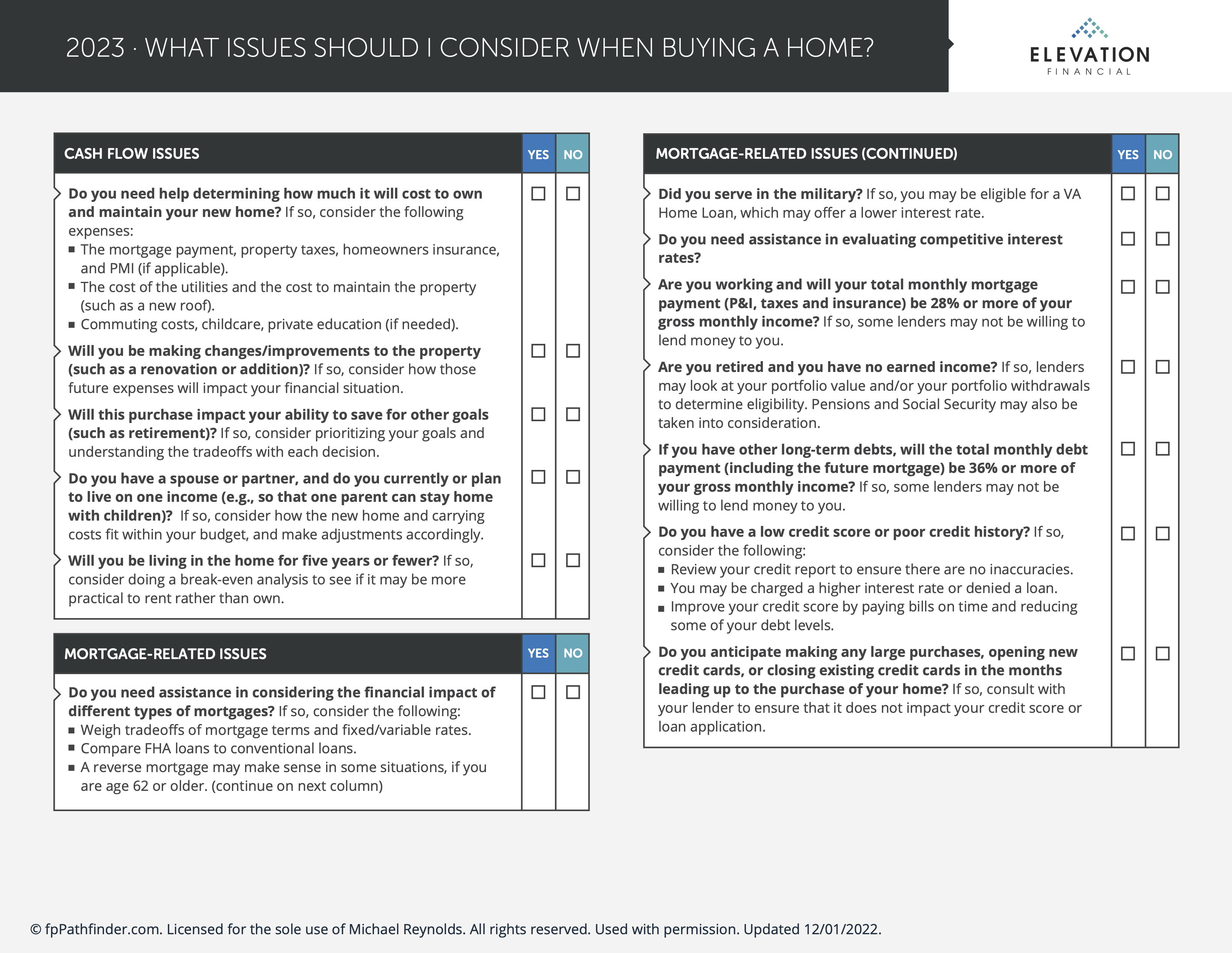

Bonus Download

Included with this article is a supplemental checklist to help you think through the process of buying a home. Download the checklist below by clicking on the image. The PDF is multiple pages so be sure to download the file to see the entire checklist.