Share this Post

Subscribe

Need help with your money or investments? Book a consultation to learn more about working together.

How Do Presidential Elections Affect the Stock Market?

[Prefer to listen? You can find a podcast version of this article here: E238: How Do Presidential Elections Affect the Stock Market?]

Every four years, as the United States gears up for a presidential election, the stock market becomes a focal point of speculation and anxiety.

Investors, analysts, and many Americans in general are concerned with how the election outcome will shape the economic landscape. Will a new administration bring about sweeping policy changes that could bolster or hinder market performance? Or will the market continue its trajectory, seemingly indifferent to the political shenanigans in Washington?

Presidential elections often bring a heightened sense of uncertainty to the stock market, but historical data suggests that the impact is not as significant or predictable as many might believe. Here are some key points to consider.

Historical Performance

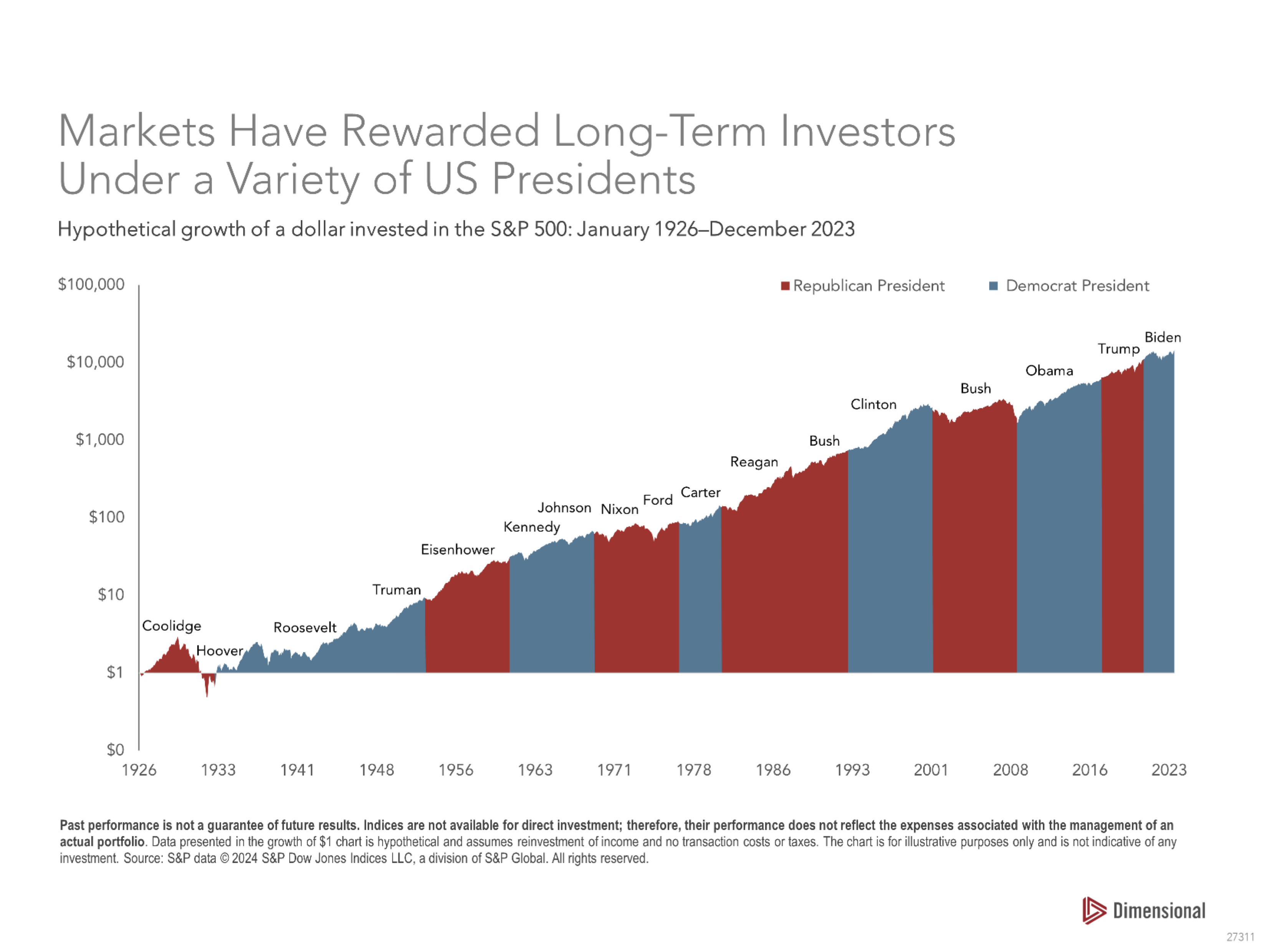

General Upward Trend: Over nearly a century, the stock market has generally trended upward regardless of which party wins the White House. This long-term growth reflects the resilience and growth of companies that make up the stock market, which focus on serving their customers and growing their businesses irrespective of political changes.

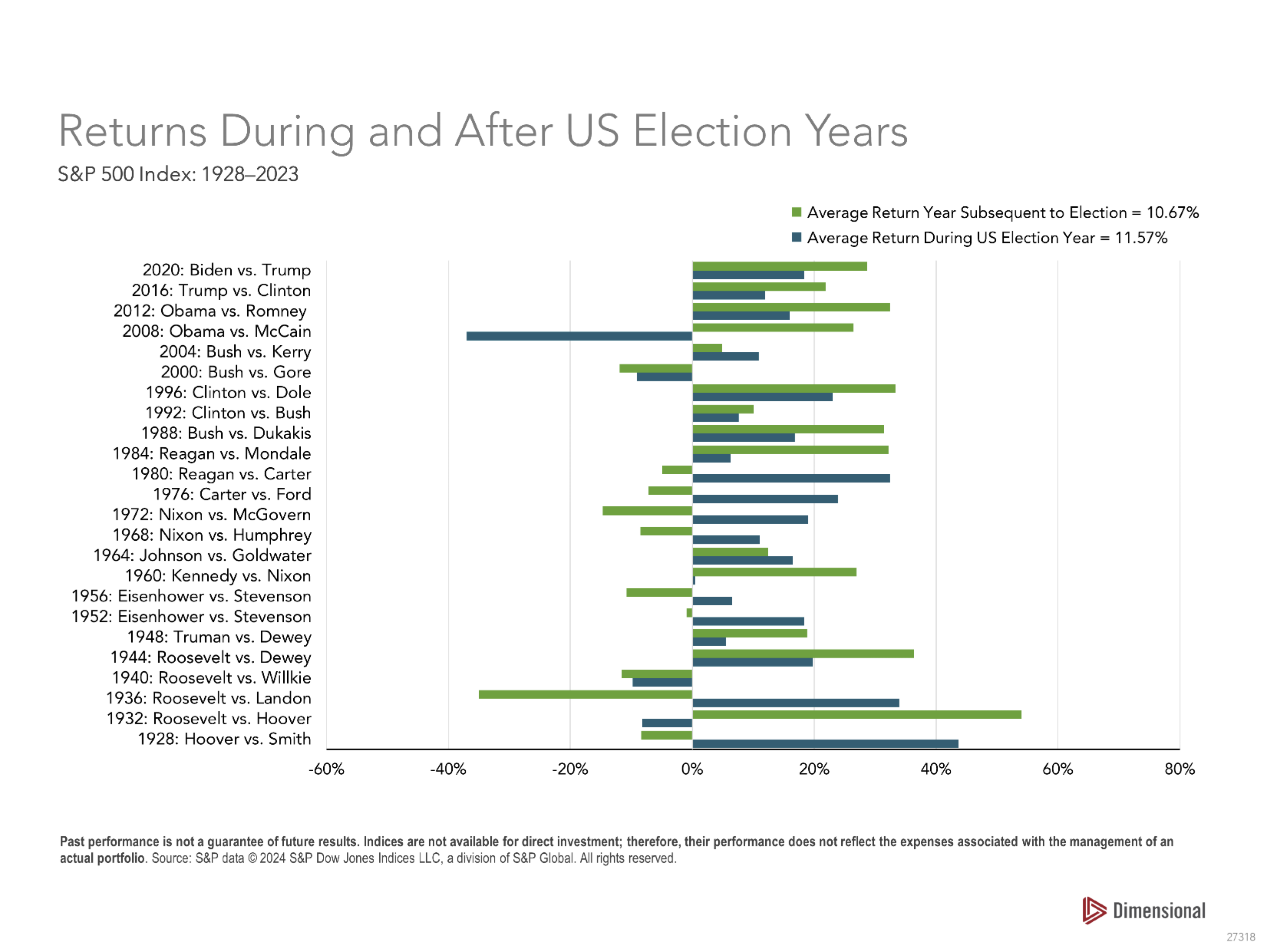

Election Year Returns: Historical data shows that the S&P 500 has delivered positive annual returns in 20 out of 24 presidential election years from 1932 through 2020. The average return during election years is around 10%, which is comparable to non-election years.

Monthly Volatility: While election years can exhibit heightened volatility, this is often more closely tied to the broader economic outlook rather than the election itself. For example, the volatility of the S&P 500 during election years is about 18%, which is slightly higher than during non-election years.

Political Party Influence

Party in Power: The stock market has performed well under both Democratic and Republican presidents. For instance, from 1932 through 2023, the average annual return was 8.6% under Democratic presidents and 6.6% under Republican presidents. However, when outlier periods are removed, the difference in returns between parties is negligible.

Divided Government: Interestingly, the stock market tends to perform better when there is a divided government. For example, the S&P 500 delivered higher annual returns (14%) when there was a Democratic president and a Republican-controlled Congress from 1932 through 2023.

Short-Term vs. Long-Term

Short-Term Reactions: In the short term, the stock market may react to the uncertainty and potential policy changes associated with an election. However, these reactions are often temporary and do not significantly alter long-term investment trends.

Long-Term Stability: Over the long term, the stock market is influenced more by economic fundamentals such as corporate earnings, interest rates, and global economic conditions than by who occupies the White House.

Investor Behavior

Avoid Emotional Decisions: Investors are often advised to avoid making emotional or rushed decisions based on election outcomes. Historical data suggests that sticking to a long-term investment plan is generally more beneficial than trying to time the market based on political events.

Economic Fundamentals: It's important to focus on economic fundamentals rather than political headlines. The strength of the economy, corporate earnings, and other macroeconomic factors play a more significant role in driving stock market performance.

Conclusion

While presidential elections can introduce short-term volatility and uncertainty into the stock market, the long-term impact is generally minimal.

Investors are typically better served by focusing on their long-term financial goals and maintaining a disciplined investment strategy rather than attempting to predict market movements based on election outcomes.