Share this Post

Subscribe

Need help with your money or investments? Book a consultation to learn more about working together.

Five Ways to Lower Anxiety in a Stressful Market

Investing can be stressful.

Whether it's in your 401(k), your IRA, or brokerage accounts, when the stock market is going down, it's natural to feel anxiety.

A colleague of mine once said "market volatility is the price of admission to access a vehicle that typically returns 8%+ return on your money".

While sayings like this are wise, it doesn't always help when we're in the moment watching account balances decrease and wondering if we'll ever see a return.

As humans, we are wired to be good at the short-term but bad at the long-term. Unfortunately, investing is a long-term pursuit which is why it can be difficult to stomach the emotions that go with it.

So if successful investing requires a long-term commitment but we're having trouble with short-term anxiety, what can we do?

While there is no magic button that makes investing easy, there are a few things we can do to help smooth out the ride (emotionally) and experience less stress.

Focus on When You Need the Money

One of the best ways to reduce stress when you see account balances go down is to remember what the money is for. Is the money for retirement in 10-20 years? If so, the balance today doesn't matter. The twists and turns along the way are a distraction.

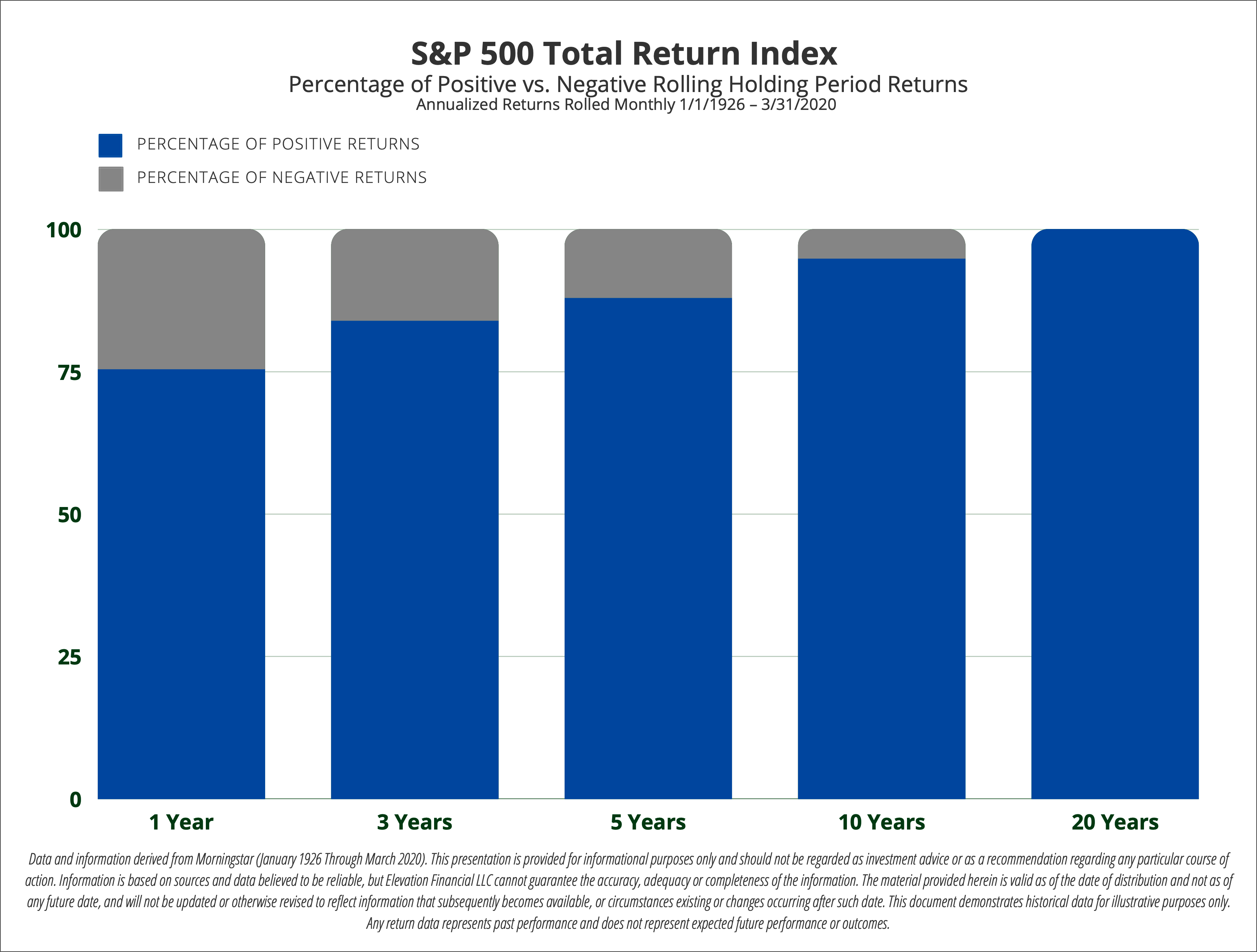

The longer your time horizon, the higher your chance of seeing a positive return. Even after five years, your chances improve dramatically.

While there is no guarantee in investing (that's why the disclaimers always say "past performance is not a guarantee of future returns"), it can be helpful to look at the probabilities of a positive return for your specific time horizon.

Then, focus on that time horizon, not your account balance today.

Tune Out the Noise

Part of our stress often comes from being yelled at by the media. Every time the stock market takes a dive, we are inundated with incendiary phrases like "the market is a bloodbath today " and "the biggest drop since XXX" etc.

The media loves to scare us. News organizations make money through clicks, eyeballs, and ads. There are some that are more objective than others but unfortunately, the loudest and scariest stories often get the most attention.

While there is often truth to what is being reported (perhaps this is the biggest market downturn since "XXX date") and that can sound terrifying when framed a certain way. But is this what really matters?

Maybe it matters to day traders and certain people and others in certain contexts. But to those of us truly investing for the future, what matters is (see above) our time horizon.

Stop Checking Your Accounts

I get it. When the media is yelling at you (see above) the first thing you want to do is look up your account balance to see what "the damage" is. It's human nature. But this can be negatively addictive.

You check your accounts and you see a decrease. You get scared. You check again. You get more scared. You check again and it's up again. You feel relief. You check again and it's down again. You get scared all over again. Rinse and repeat.

Not only is this stressful, this vicious cycle can be harmful to your financial future.

The more you check your account balance, the more you will feel the need to "do something about it". But the very act of doing something about it is what hurts your financial future.

For the 20 years ending December 31, 2019, the S&P 500 Index averaged 6.06% per year. However, the average equity fund investor earned a market return of only 4.25%. Why? Overreacting during times of uncertainty.

Even well-known investor Warren Buffett has stated in the past that he does not check his investments on a daily basis.

If you find yourself getting anxious because you are checking your accounts all the time, consider moving your investing apps to a secondary screen on your phone or deep within another folder so it's not so readily available. Or even delete them from your phone. Many people go on a "social media fast" by deleting social apps from their phone and this can be a similar way to keep you from indulging in unhealthy investment monitoring.

Focus On What You Can Control

You can't control the stock market. So what can you control? You have control over your spending. You have control over how you manage your debt. You have control over how you create an income (which can include asking for a raise at work or starting a business). You have control over your risk management through insurance. You have control over your cash flow planning.

There are a lot of things about your financial life that you can control.

The market can feel scary in part because it's difficult to understand how it works and it can feel chaotic and beyond our control. To many people, it's a "black box". Replacing that feeling of stress with things that we actually can control can be a good way to soothe market-related anxiety.

By focusing your attention on these areas of your financial life, you not only focus less on today's market performance but you will also be more intentional with your money.

Believe in Innovation

When financial news is scary, it can be very easy to develop a pessimistic perspective to the point of fearing that the whole system is melting down. It can cause people to pull their money out of investments, run to gold, or pin their hopes on questionable "investments" from sources selling fear.

However, betting against the stock market is betting against innovation. The market is fundamentally based on the innovation and growth of our largest companies. The companies that drive our economy have a goal: to make money. They want to make money no matter who is president, which political party is in power, what the interest rates are, or what is going on in the world. The stock market is how we are able to participate in that growth and innovation.

So if you believe that American (and global) businesses want to keep growing and innovating, then by extension the stock market has a bright future.