Share this Post

Subscribe

Need help with your money or investments? Book a consultation to learn more about working together.

Five Behaviors That Diminish Your Investment Returns

[Prefer to listen? You can find a podcast version of this article here: E184: Five Behaviors That Diminish Your Investment Returns]

Investing is both an art and a science. The science part is driven by understanding the fundamentals and applying technical principles to your strategy. This may seem like the hard part, but often it's the other side of the coin that proves more difficult.

The "art" side of investing can be challenging because it's driven by behavior and emotions.

From 2001 - 2020, the S&P 500 has returned 7.5%. However, according to research by JP Morgan, the average investor has achieved only 2.9% in returns in that same time period. Why is that?

Behavior.

It's usually not some specific technical decision that diminishes investment returns. It's human behavior.

Here are five behaviors that can suppress investment returns…

Stopping your recurring contributions when the market goes down

When the market drops, it can feel scary and many will be tempted to “push pause” and sit on the sidelines until things go up again.

But this unplugs your investing schedule at a time when it’s even more of an advantage to buy into the market. Market downturns are among the best times to continue investing every single month because you are buying in at a discount.

Moving your investments to cash based on fear

Fear can cause many to move to cash during a downturn because they don’t like seeing their account balance go down.

But as long as your investments are aligned with your plan and your time horizon, staying invested is the right move.

Going to cash is an attempt to time the market and can cause you to miss out on the recovery, thus stifling your potential growth.

Take a look at this data from Dimensional Fund Advisors which shows the outcome of missing the best days in the market due to sitting in cash:

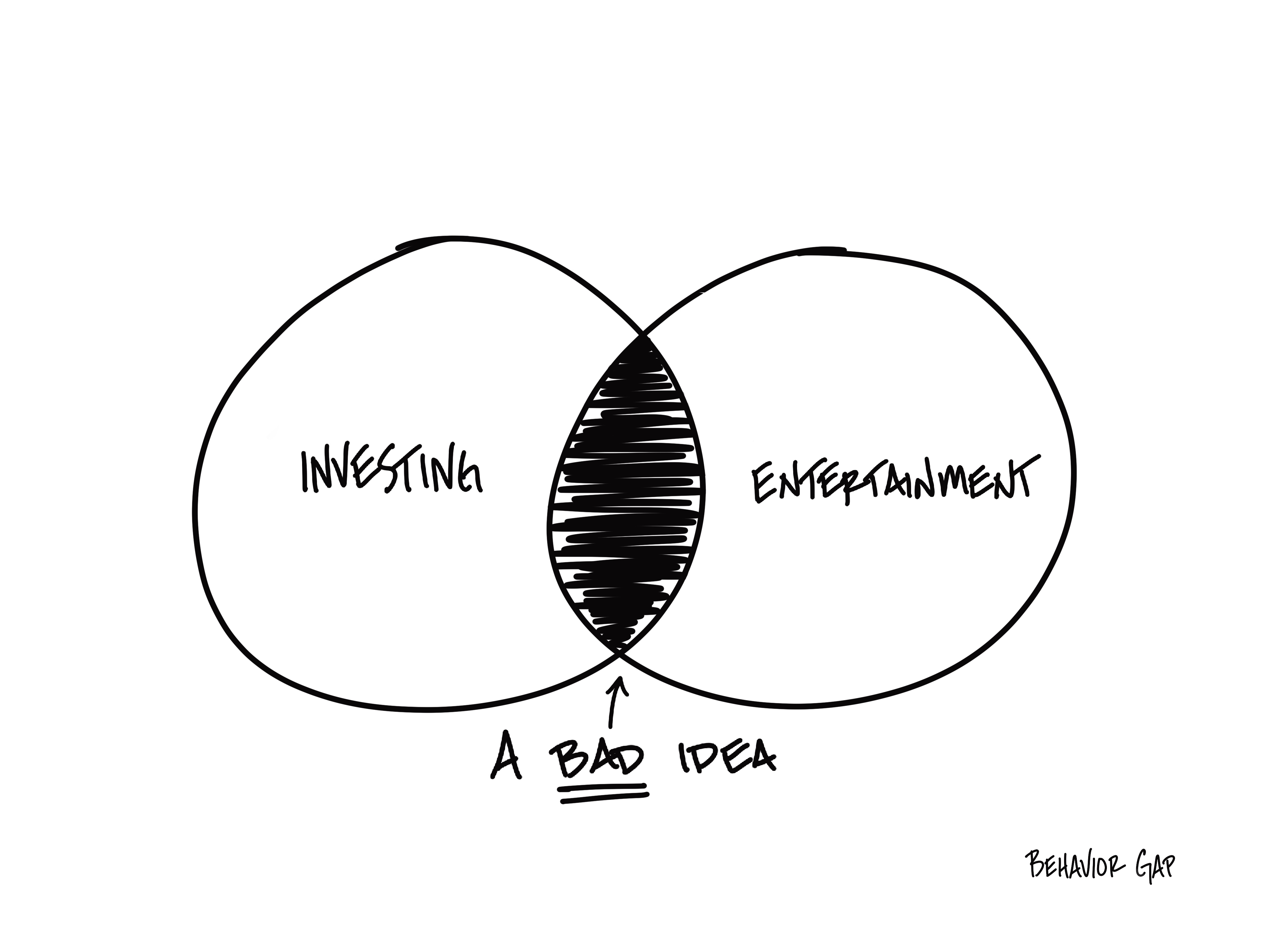

Chasing the latest shiny object

There is no shortage of noise out there enticing us to invest in any number of “hot stocks”, alternative investments, or “exciting opportunities”.

Chasing these alleged get rich quick promises will often lead to disappointment and even significant losses. Reliable investing is boring but it works.

Accepting “default” suggestions

When setting up your 401(k), IRA, or other investment accounts you will often be presented with suggested portfolios.

While somewhat useful, these suggestions are no substitute for doing your own evaluation of your financial situation and risk profile (possibly with the help of a financial advisor).

It can seem easier to click a button and accept a default suggestion but over time this can lead to lower returns if the portfolio is not aggressive enough for your financial situation.

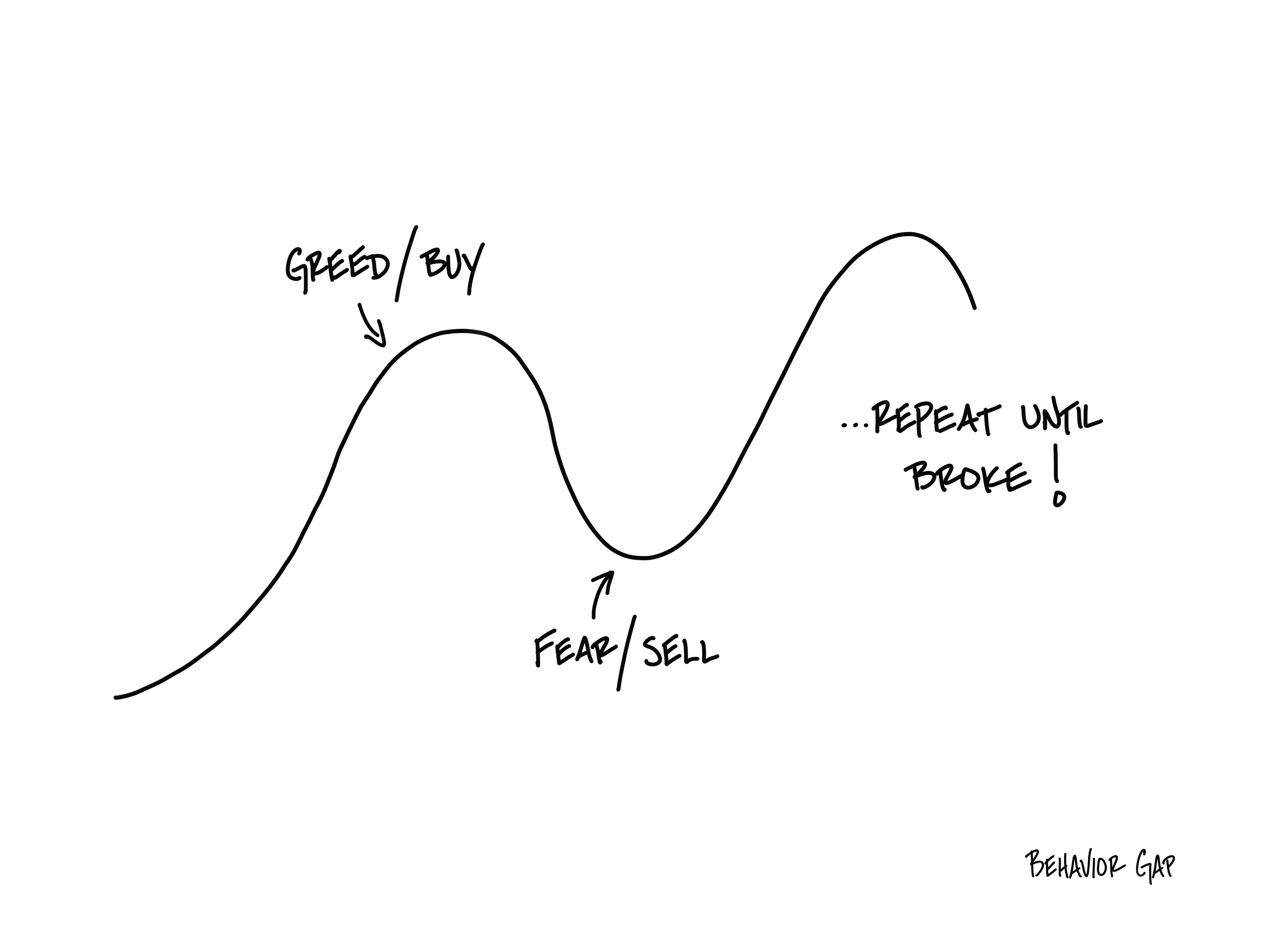

Buying high and selling low

A common pattern among investors is to buy when the market is high because it makes them optimistic.

Then they sell when the market is low because they are scared. They then repeat this cycle and end up locking in years of losses while consistently investing at a premium.

Over time, this behavior can significantly suppress returns. It’s much better to stay invested and continue a pattern of recurring contributions.

Avoid these behaviors to avoid being an "average" investor!