Share this Post

Subscribe

Need help with your money or investments? Book a consultation to learn more about working together.

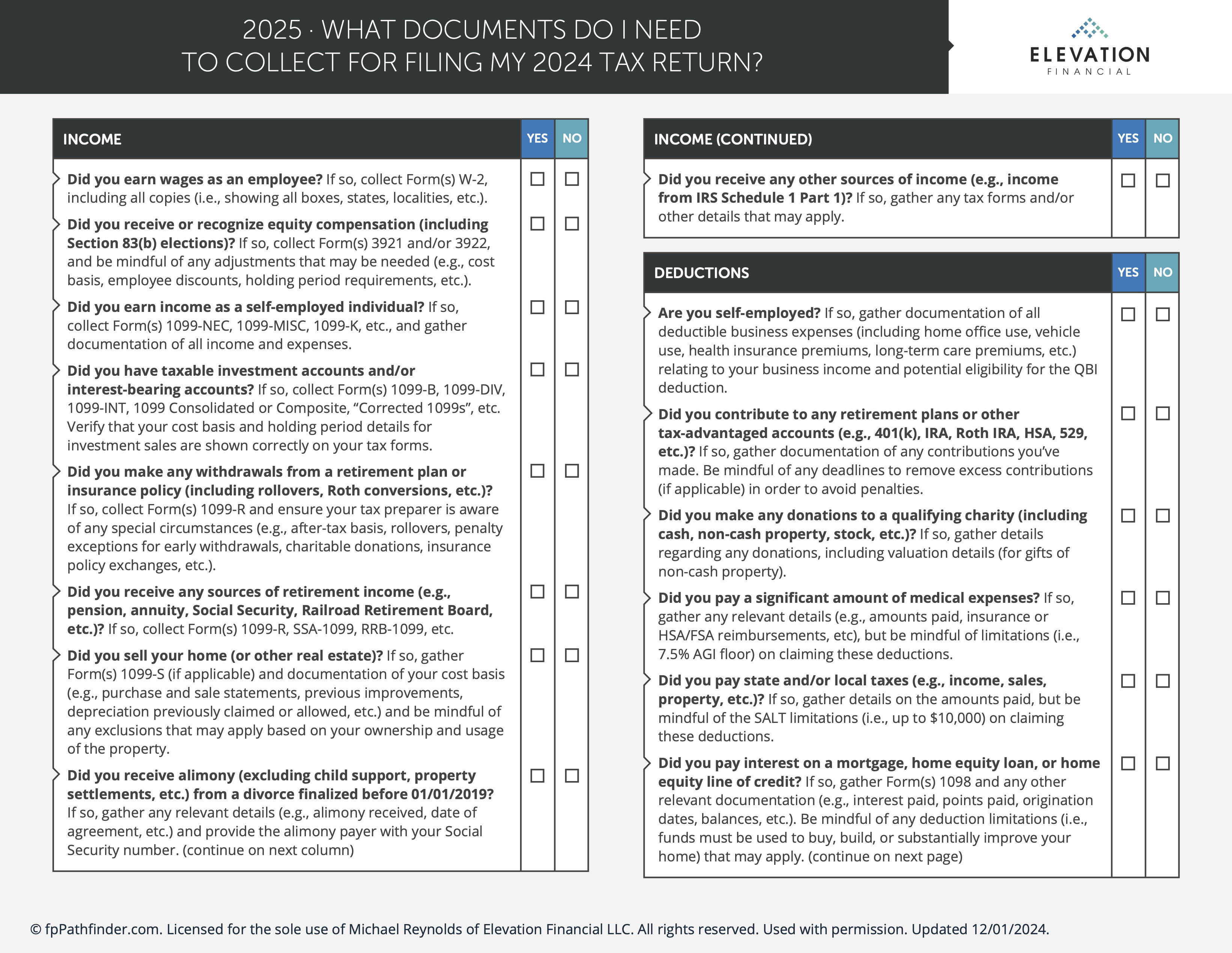

A Checklist of Documents for Filing Your 2024 Tax Return

[Prefer to listen? You can find a podcast version of this article here: E246: A Checklist of Documents for Filing Your 2024 Tax Return]

As tax season approaches, staying organized can save you time, stress, and even money. To make filing your 2024 tax return easier, here’s a checklist of documents you may need, depending on your income sources, deductions, and tax credits.

This is meant to be a list of the most common items needed for filing taxes. It is not an exhaustive list. If you have a more complex situation, you may have documents not listed here.

1. Income Documentation

Ensure you have records of all your income sources, including:

- Wages: Form(s) W-2 for all jobs held in 2024.

- Self-Employment Income: Form(s) 1099-NEC, 1099-MISC, or 1099-K, plus records of income and expenses.

- Investments: Form(s) 1099-B, 1099-DIV, 1099-INT, and any Consolidated or Corrected 1099s.

- Retirement Income: Form(s) 1099-R for distributions or rollovers, and SSA-1099 or RRB-1099 for Social Security or Railroad Retirement benefits.

- Equity Compensation: Form(s) 3921 and/or 3922 for stock options or awards.

- Real Estate Sales: Form(s) 1099-S and documentation of purchase and sale details, including improvement records.

- Other Income: Any other relevant tax forms, such as alimony received (pre-2019 agreements) or income listed in IRS Schedule 1.

2. Deduction Records

Maximize your tax savings by collecting:

- Retirement Contributions: Records of contributions to 401(k), IRA, Roth IRA, HSA, or 529 plans.

- Charitable Contributions: Documentation of cash, property, or stock donations, including valuation details.

- Medical Expenses: Receipts and records of expenses exceeding 7.5% of your adjusted gross income (AGI).

- State and Local Taxes: Proof of property, income, or sales taxes paid, subject to the $10,000 SALT limit.

- Mortgage Interest: Form(s) 1098 and details about home equity loans (if used for qualifying purposes).

- Student Loan Interest: Form(s) 1098-E for interest paid on qualified loans.

- Other Deductible Expenses: Documentation for deductions on IRS Schedule 1, such as alimony paid (pre-2019 agreements).

3. Credit Documentation

Prepare for applicable tax credits by gathering:

- Education Expenses: Form(s) 1098-T, 1099-Q, and receipts for tuition, books, and supplies.

- Dependent Care: Records of childcare or adoption expenses, and Form(s) 8332 for custody agreements.

- Energy-Efficient Improvements: Receipts for electric vehicles or energy-efficient home upgrades.

- Health Insurance: Form(s) 1095-A if purchased through the Marketplace, and details of any premium tax credits.

4. Business Owners and Rental Property

If you own a business or rental property:

- Business Tax Returns: Form(s) 1120-S or 1065, if applicable, before filing personal returns (including K-1s).

- Solo 401(k): If the balance of your Solo 401(k) exceeded $250,000 by year-end, file Form 5500-EZ by July 31, 2025.

- Rental Property: Records of rental income, expenses, depreciation, and usage time (personal vs. rental).

5. Miscellaneous

Don’t overlook:

- Gift Tax Reporting: If gifts exceeded $18,000 per recipient in 2024, complete Form 709.

- Qualified Charitable Distributions (QCDs): Ensure these are excluded from taxable income.

- Estimated Tax Payments: Proof of estimated tax payments made throughout the year.

- State-Specific Issues: Review any unique tax considerations for your state.

Tips for Filing Success

- Start Early: Avoid the last-minute rush by gathering these documents now.

- Use a Checklist: Stay organized by checking off items as you collect them.

- Consult a Professional: If you have complex taxes, consider hiring a tax professional to ensure accuracy.

If you would like a downloadable version of this checklist, please grab a copy of it via PDF (click on the image below)...

With this checklist in hand, you’re ready to tackle your 2024 tax return with confidence. Happy filing!